微信理财哪种比较稳健

Title: Exploring Secure Investment Options on WeChat

In the realm of financial management, seeking secure investment avenues is paramount. When it comes to WeChat, a popular social networking platform in China, several options exist for those desiring to invest while prioritizing capital preservation. Let’s delve into some of the key strategies for secure financial management on WeChat:

1. WeChat Wealth Management Platforms:

WeChat offers various wealth management platforms that provide products with different risk levels, including those focused on capital preservation. These platforms often collaborate with reputable financial institutions to offer investment products such as money market funds, fixedincome products, and lowrisk wealth management products.

2. Money Market Funds:

Money market funds are popular among investors seeking capital preservation. These funds primarily invest in shortterm, lowrisk securities like Treasury bills, certificates of deposit (CDs), and commercial paper. They aim to provide stable returns while minimizing the risk of capital loss. WeChat facilitates access to several money market funds through its financial services section.

3. FixedIncome Products:

Fixedincome products, including bonds and bond funds, can also be considered for capital preservation. These instruments offer regular interest payments and return the principal amount upon maturity, making them relatively safe investment options. WeChat’s wealth management platforms often feature fixedincome products suitable for riskaverse investors.

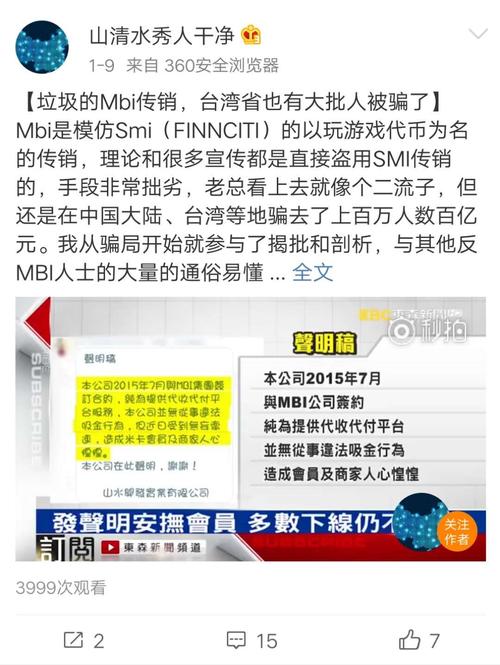

4. PeertoPeer (P2P) Lending Platforms:

While P2P lending platforms can offer relatively higher returns, they also come with increased risks. However, some P2P platforms on WeChat may offer options with stringent risk management protocols, focusing on protecting investors' capital. It’s crucial to conduct thorough due diligence and invest only in platforms with a proven track record of risk management and transparency.

5. Government Bonds:

Investing in government bonds is another avenue for capital preservation. Government bonds are considered lowrisk investments as they are backed by the government’s credit, offering a reliable stream of income through periodic interest payments and returning the principal amount upon maturity. WeChat may provide access to government bond investment opportunities through its financial services partners.

6. Consultation with Financial Advisors:

Seeking advice from qualified financial advisors can significantly aid in selecting suitable investment options. Financial advisors can assess individual risk tolerance, financial goals, and investment horizon to recommend personalized investment strategies tailored to one’s needs. WeChat may facilitate access to financial advisory services through its network of professionals.

Conclusion:

WeChat serves as a versatile platform for accessing a range of investment products, including those focused on capital preservation. From money market funds to fixedincome products and government bonds, investors have several options to safeguard their capital while earning competitive returns. However, it’s essential to conduct thorough research, evaluate risk factors, and seek professional advice before making investment decisions. By leveraging WeChat’s wealth management platforms and consulting with financial experts, investors can navigate the financial landscape with confidence, ensuring their investment strategies align with their objectives for capital preservation and growth.