Title: Exploring USDT Investment Opportunities

In recent years, USDT (Tether) has gained significant attention as a stablecoin in the cryptocurrency market. While primarily used as a stable alternative to volatile cryptocurrencies, some individuals are exploring USDT as a tool for investment and wealth management. Let's delve into the concept of USDT investment and understand its potential benefits and risks.

Understanding USDT:

USDT, or Tether, is a type of cryptocurrency known as a stablecoin. Its value is pegged to a fiat currency, typically the US dollar, with the aim of maintaining stability and minimizing volatility. This stability makes USDT an attractive option for investors looking to safeguard their assets against market fluctuations.

USDT Investment Options:

1.

Direct Holding

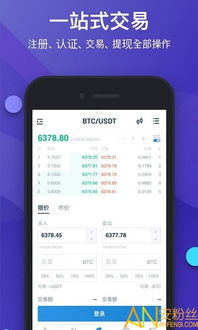

: The simplest way to invest in USDT is by purchasing and holding it in a cryptocurrency wallet. This approach allows investors to benefit from the stability of USDT without exposure to the volatility of other cryptocurrencies.2.

USDT Savings Accounts

: Some cryptocurrency platforms offer USDT savings accounts with interestbearing features. Investors can deposit their USDT into these accounts and earn interest over time. However, it's essential to research the platform's credibility and understand the associated risks, such as platform security and regulatory compliance.3.

USDT Lending and Borrowing

: Certain platforms facilitate peertopeer lending and borrowing of USDT. Investors can lend their USDT to others and earn interest on their holdings, or borrow USDT against collateral for various purposes. However, caution is advised when participating in lending and borrowing activities, as they involve counterparty risk and potential liquidation of collateral.4.

Stablecoin Yield Farming

: Yield farming involves providing liquidity to decentralized finance (DeFi) protocols in exchange for rewards, often in the form of additional tokens or interest. Some DeFi platforms offer opportunities to farm yields using stablecoins like USDT. Investors should thoroughly research the protocols, assess risks, and consider factors such as smart contract security and impermanent loss.Benefits of USDT Investment:

1.

Stability

: As a stablecoin pegged to a fiat currency, USDT offers stability compared to volatile cryptocurrencies like Bitcoin or Ethereum.2.

Liquidity

: USDT is widely accepted across various cryptocurrency exchanges and trading platforms, providing high liquidity for investors.3.

Diversification

: Including USDT in an investment portfolio can help diversify risk, especially during periods of market uncertainty or downturns.

4.

Interest Earning

: Through USDT savings accounts or lending platforms, investors have the opportunity to earn interest on their holdings, potentially increasing their wealth over time.Risks and Considerations:

1.

Regulatory Risks

: The regulatory landscape surrounding cryptocurrencies and stablecoins is continually evolving. Investors should stay informed about regulatory developments and potential impacts on USDT investments.2.

Counterparty Risk

: When participating in lending, borrowing, or yield farming activities, investors are exposed to counterparty risk—the risk that the other party may default on their obligations.3.

Market Risks

: While USDT aims to maintain a stable value, market dynamics or disruptions could impact its stability. Investors should monitor market conditions and be prepared for potential fluctuations.4.

Security Risks

: Storing USDT on cryptocurrency exchanges or platforms exposes investors to security risks such as hacking or theft. It's crucial to use reputable platforms with robust security measures and consider using hardware wallets for additional security.Conclusion:

USDT presents various investment opportunities for individuals seeking stability and diversification within the cryptocurrency market. Whether through direct holding, savings accounts, lending platforms, or yield farming, investors can leverage USDT to potentially earn returns while mitigating volatility risks. However, it's essential to conduct thorough research, understand the associated risks, and exercise caution when participating in USDT investment activities. By staying informed and adopting prudent investment strategies, investors can capitalize on the benefits of USDT while managing potential risks effectively.

Considering the interest in USDT investment, I outlined different investment options, benefits, risks, and considerations. Let me know if you'd like to explore any specific aspect further!