进取类理财产品有哪些

Examples of Aggressive Investment Products

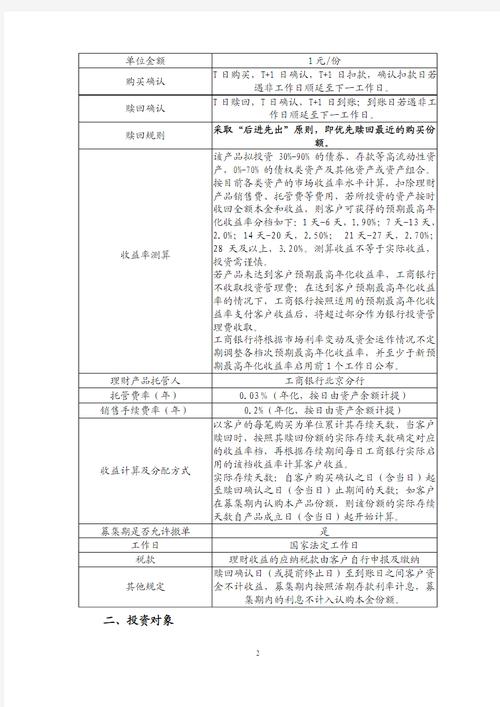

Aggressive investment products are tailored for investors who are willing to take on greater risk in pursuit of higher returns. These products typically include a combination of highrisk assets such as equities, commodities, and alternative investments. Here are some examples of aggressive investment products:

Growth stocks are shares in companies that are expected to grow at a rate significantly above the average for the market. These stocks typically reinvest earnings to fuel further expansion, rather than paying dividends. Growth stocks can offer substantial returns, but they also come with a higher level of volatility and risk.

Leveraged exchangetraded funds (ETFs) use financial derivatives and debt to amplify the returns of an underlying index. These funds aim to double or triple the daily or monthly return of the index they track. While leveraged ETFs can generate significant returns in a short period, they are also subject to higher levels of risk and are not suitable for longterm investment.

Venture capital funds invest in earlystage companies with high growth potential. These investments are illiquid and highly risky, as many startups fail to achieve success. However, successful investments in venture capital funds can generate substantial returns for investors.

Emerging market funds invest in the stocks and bonds of companies located in developing countries with rapidly growing economies. While these funds offer the potential for high returns, they are exposed to risks such as political instability, currency fluctuations, and lack of transparency in regulatory environments.

Highyield bonds, also known as junk bonds, are issued by companies with lower credit ratings than investmentgrade bonds. These bonds offer higher interest payments to compensate investors for the increased risk of default. Investing in highyield bonds can provide higher returns, but they are sensitive to changes in economic conditions and interest rates.

Before investing in aggressive products, it is essential for investors to assess their risk tolerance, investment goals, and time horizon. These products are best suited for individuals with a high risk tolerance and a longterm investment horizon. Consulting with a financial advisor can help investors determine the most suitable aggressive investment products based on their financial situation and goals.